Sign the Petition!

As strong as the case stands on Constitutional merits, grass roots support for the initiative will communicate to the Justices that property taxation has finally become crushing for the average citizen. Leave your details, and receive updates. Once the class action suit is filed, you will be invited to join as a separate step.

Welcome Statement

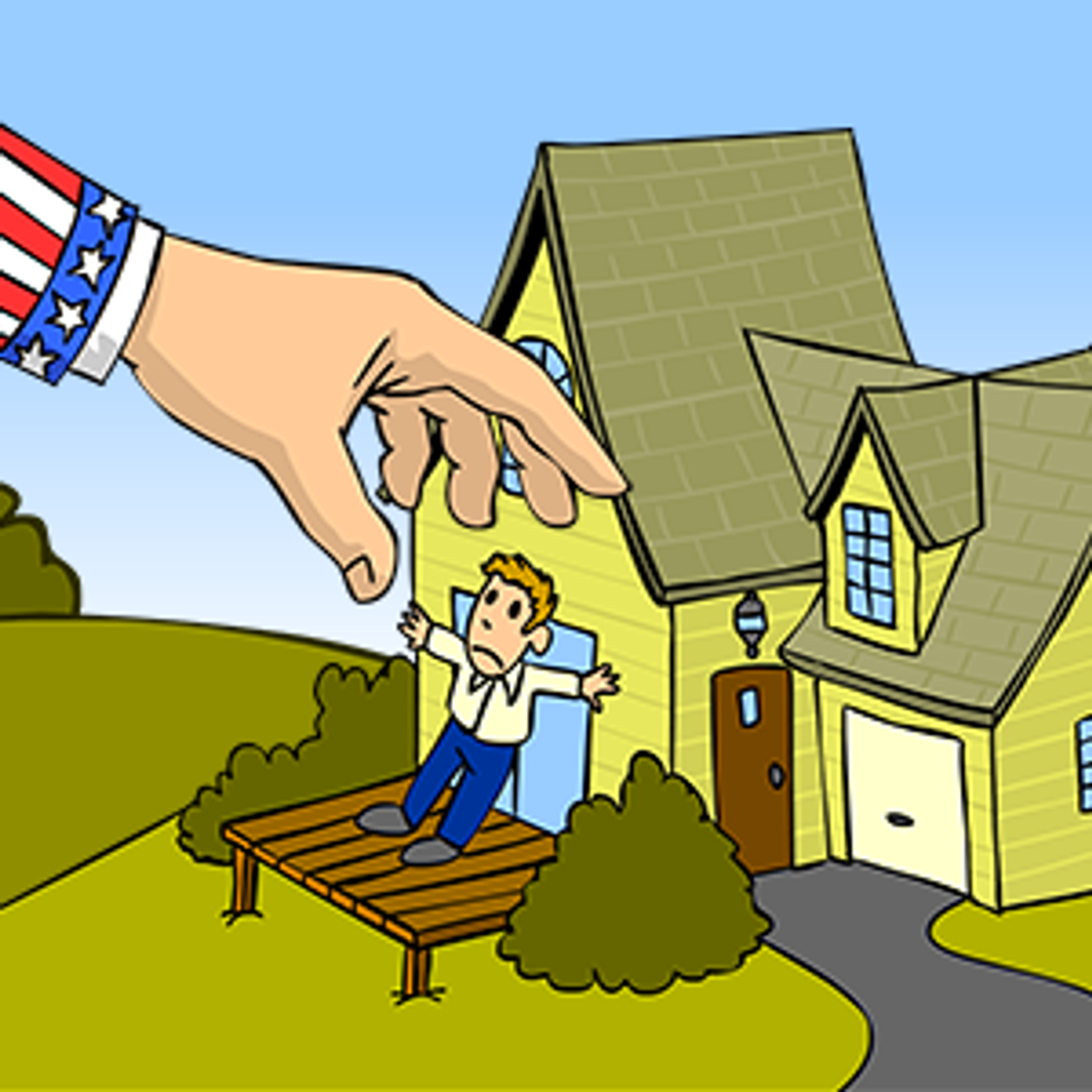

Welcome to Hoodwinked, and thank-you for delving into the many U.S. Constitutional protections prohibiting home taxation.

As you will find, the U.S. Constitution was never amended to subordinate property, permitting open-ended taxation of private homes and vehicles by municipalities. Instead, the Constitution’s Origination, Equal Protection, Property Taking, Contract, Due Process & Direct Taxation clauses specifically protect property from taxation.

Funding for State-mandated programs - like Free K-to-12 and Code Administration - must originate solely through legislatively-raised taxes, not by taxing private homes via town budget votes,. This is spelled out in the U.S. Constitution’s Tax Origination clause.

Legislative scrutiny remains the key for keeping taxation at bay. Yet in modern times, with State legislatures circumvented via municipal voting, unchecked home taxation and unequal treatment under the law have become the norms at both household-to-household, and municipality-to-municipality levels in every State.

As envisioned, to replace home taxation with State funded income & sales tax sources, town mayors need to invite the Department of Justice to defend their residents through a Federal class action suit brought against the respective State authorities.

Stay tuned for updates as the project takes shape.

Joe Patrina